Green Street maintains hundreds of unique cap rate series, encompassing the current and historic values for all major property sectors, all major U.S. But before investors incorporate cap rate data into their investment decision-making process, they must first know how the cap rates were calculated, and must then standardize that data among all of the other transaction, market, sector, and company cap rate data they may be working with. Fundamentally, cap rates provide investors with signals on the market pricing for investments. While cap rates alone are not a sufficient basis for making investment decisions, they are a powerful starting point.

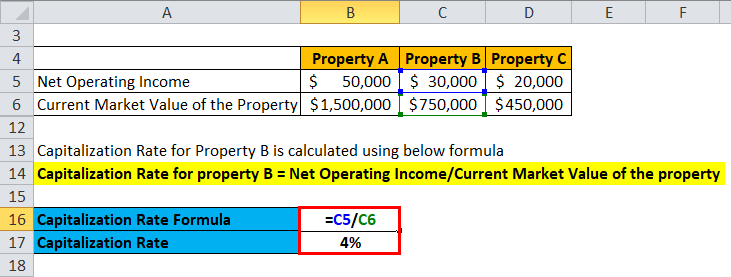

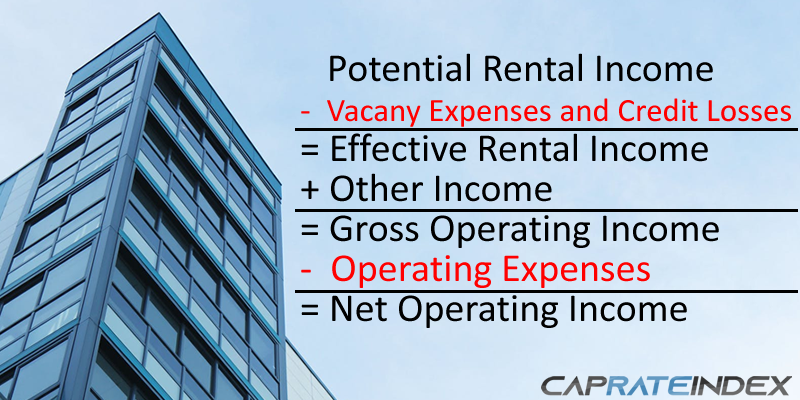

All of these standard deductions are far lower than what an owner actually spends, and they are simply helpful to normalize quoted cap rates. * Different property sectors have different “standard” cap-ex deductions. Green Street quotes all three on a pro-forma income basis. And, each of those cap rates can be quoted based on pro- forma or trailing income. Three of the more common cap rate definitions that use different cap-ex reserve assumptions are nominal, market, and economic cap rates. Capital expenditures are the costs associated with the long-term ownership of commercial real estate that are capitalized, not expensed. Net operating income can also be calculated including or excluding capital expenditures (or cap-ex for short). Cap rates using either approach are both technically correct, they are just calculated differently. In periods of rapidly increasing or decreasing income, these two numbers can be materially different. For example, the income could be calculated on a pro- forma basis (i.e., estimated next 12 months), or it could be calculated based on the most recent trailing three-months of income, annualized. The difference usually stems from the calculation of net operating income. It is common for investors to see multiple cap rates quoted for a single transaction. Like earnings multiples, not all cap rates are created equal. Yield and cap rate are two sides of the same valuation coin. Many investors focused outside of real estate often use the inverse of the cap rate to look at the same information cap rates are essentially an inverse earnings multiple, therefore a cap rate of 5% is analogous to a 20x earnings multiple. Cap rates have an inverse relationship to asset value, so when asset values rise, cap rates fall, and vice-versa. Investors who know or can estimate any two of the variables - NOI, asset value, or cap rate – can calculate the third. For example, a property that recently changed hands for $100 million and is expected to produce income of $5 million has a cap rate of 5%. Mathematically, it’s the net operating income (rents minus expenses), or “NOI,” expressed as a percentage of a property’s value.

In the simplest sense, a cap rate is the yield generated by a property or group of properties. As such, it’s important to understand that a variety of definitions exist, and also what each one means. Unfortunately, the world of commercial real estate has not adopted a standardized definition for cap rates that market participants could universally adopt. The cap rate is a useful tool to compare market pricing across transactions, markets, sectors, and even publicly traded REITS, and it can serve as a base for real estate investment decisions. One of the metrics most widely used by real estate investors is the capitalization rate, or cap rate.

0 kommentar(er)

0 kommentar(er)